Companies do not intend to hold such securities for a long period of time. Businesses hold short-term securities for which of the following reasons.

/GettyImages-824185000-03c0d898d7e449ac8fef137d17f73dd1.jpg)

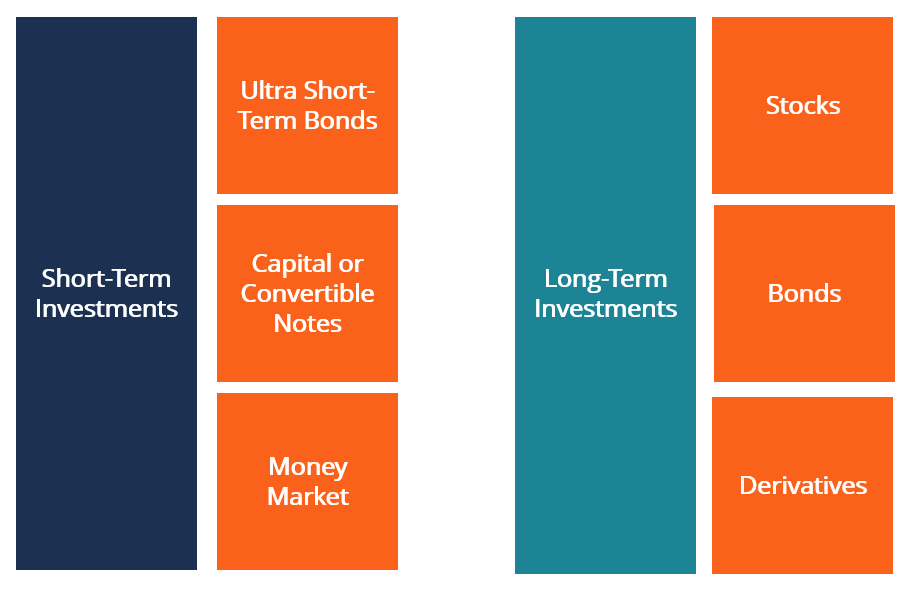

Common Examples Of Marketable Securities

In the bond duration department companies that need short-term funding can issue bonds that mature in a short time period.

/GettyImages-824185000-03c0d898d7e449ac8fef137d17f73dd1.jpg)

. All of the following are valid reasons for a business to hold cash and marketable securities except to. Answer D is correct. Treasury bill rates commercial paper is a valuable short-term financing source for high quality business firms.

Short-term investments help diversify income types in case of market volatility. A As a substitute for cash B As a temporary repository for cash being accumulated for a specific purpose C As a buffer against bad debt losses. The term yield curve refers to the relationship between the short- and long-term interest rates of fixed-income securities issued by the US.

Treasury bills Eurodollars commercial paper money- market mutual funds with portfolios of short-term securities bankers acceptances floating rate preferred stock and negotiable CDs of US. That is protection of principal takes precedence over amount of return. A high-yield savings account at a bank or credit union is a good.

These securities tend to mature in a year or less and can be either debt or equity. Businesses hold short term securities for which of the following reasons. Question 19 Businesses hold short-term securities for which of the following reasons.

As a substitute for cash. A company may choose to speculate on various. Businesses hold short-term securities for which of the following reasons.

More efficient management of working capital assets will lessen the firms need to obtain financing. Answers a and b e. As a temporary repository for cash being accumulated for a specific purpose c.

An inverted yield curve occurs when short. A consultant recommends that a company hold funds for the following two reasons. Answers a b and c.

These short-term liquid securities can be bought or sold on a public stock exchange or a public bond exchange. Minimize the amount of short-term financing c. All of the following are valid reasons for a business to hold cash and marketable securities except to.

Hold substantial amounts of liquid assets b. Which of the following statements about short-term debt isare most correct. Short-term investments take on lower risk making them stable options.

As a buffer against bad debt losses d. Because commercial paper rates are typically below the US. Businesses hold short-term securities for which of the following reasons.

Cash needs can fluctuate substantially throughout the. Answers a and b e. Cash balance is required to meet the day to day transactions of business.

Answers a b and c. Which means that the business runs out of less than 10 percent of its inventory items in any given year. Finance questions and answers.

Here are a few of the best short-term investments to consider that still offer you some return. As a temporary repository for cash being accumulated for a specific purpose. D Both A B above E A B C.

Businesses hold short-term securities for which of the following reasons. Finance fluctuating assets with long-term financing d. Fluctuating current assets with short-term debt.

As a substitute for cash As a temporary repository for cash being accumulated for a specific purpose. Businesses hold short-term securities for which of the following reasons. A b and c.

All of the following are reasons for holding cash except for the Precautionary motive. Businesses hold short-term securities for which of the following reasons. As a temporary repository for cash being accumulated for a specific purpose c.

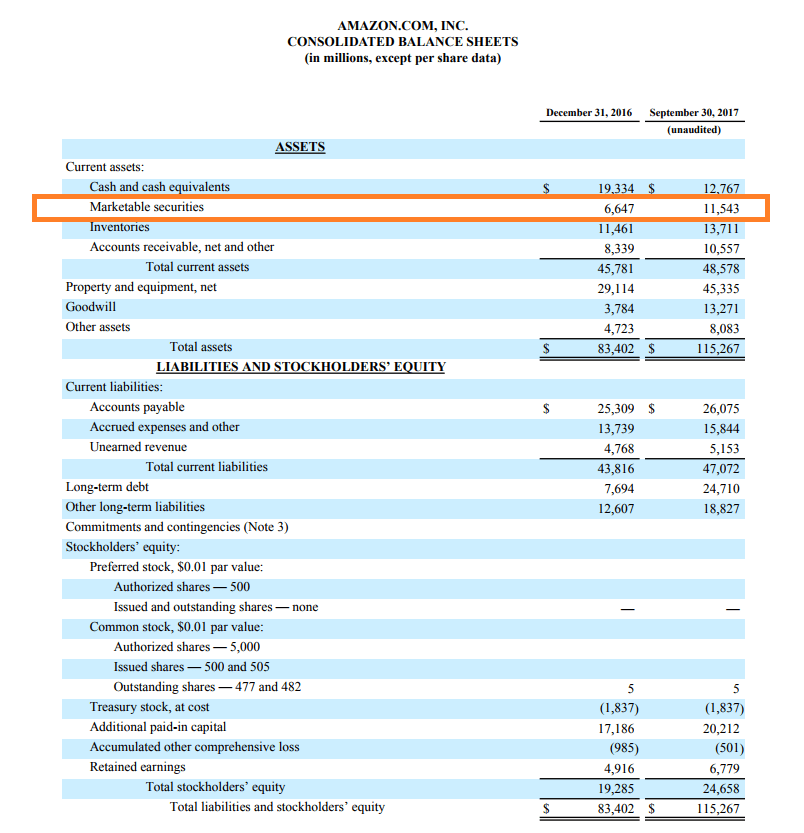

As a substitute for cash. Trading securities are securities purchased by a company for the purpose of realizing a short-term profit. Marketable securities are near-cash items used primarily for short-term investment.

As a buffer against bad debt losses d. As a buffer against bad debt losses In general short-term securities are chosen on the basis of safety. Thus they will only invest if they believe they have a good chance of being compensated for the risk they are taking.

The following points highlight the five main motives for holding cash balances in a firm. As a temporary repository for cash being accumulated for a specific purpose c. Are both correct EAnswers a b and c.

Minimize the amount of funds held in liquid assets 11. As a substitute for cash As a temporary repository for cash being accumulated for a specific purpose As a buffer against charity care and bad-debt losses Both a. Businesses hold short-term securities for which of the following reasons AAs a substitute for cash BAs a temporary repository for cash being accumulated for a specific purpose CAs a buffer against bad debt losses D.

Companies with sufficient credit quality that need long-term funding can. As a buffer against bad debt losses d. As a substitute for cash b.

As a substitute for cash b. A firm following an aggressive working capital strategy would. Businesses hold short-term securities for which of the following reasons.

As a substitute for cash b.

Short Term Investors Vs Long Term Investors Overview

/GettyImages-824185000-03c0d898d7e449ac8fef137d17f73dd1.jpg)

0 Comments